This research paper attempts to provide an overview of American Depository Receipts (‘ADRs’) and its related aspects. ADRs are a common way for United States of America (‘US’ or ‘USA’ or ‘America’) resident investors to buy equity in non-US companies without the difficulties sometimes associated with cross-border investment transactions. ADRs are priced in US dollars, pay dividends in US dollars and can be treated like shares of US companies. ADRs are issued by a US commercial bank and represent a fixed number or a fixed fraction of foreign registered shares, depending on the ratio of ADRs to ordinary shares of the issuing entity.

This paper also discusses the key benefits of trading in ADRs and the types of ADR facilities. This paper is intended especially to act as guidepost to Indian companies considering entering the ADR regime.

Many US investors prefer to purchase ADRs rather than shares in the issuer’s home market because ADRs trade, clear and settle according to US market practices. Most ADRs like equity shares can be transferred and redeemed as well. ADRs also allow easy comparison to securities of similar companies as well as access to price and trading information. ADR holders also appreciate prompt US dollar dividend payments and corporate action notifications.

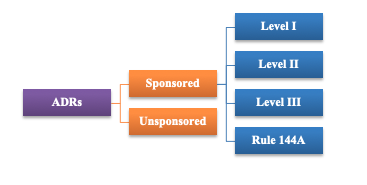

ADRs are either unsponsored or sponsored, following the recent trend; sponsored ADRs are favoured by foreign private issuers who enjoy several benefit and facilities as it reaches to the broader level of potential shareholders. Sponsored ADRs are either unlisted which includes Level 1 programs and are exempted from US reporting requirements under Rule 12g3-2(b) compliances or listed on the three major US exchanges – The New York Stock Exchange, The American Stock Exchange and the National Association of Securities Dealers Automated Quotation System which includes Level II and Level III programs.

The paper then goes on to discuss in detail, the Indian regulatory framework in place with regard to ADRs. In India, earlier the ADR holders were not entitled to voting rights but after many deliberations SEBI recently included, the acquisitions through ADRs provided they are converted into shares carrying voting rights and thereby shall attract the manner and procedure for the acquisition of shares or voting rights, under SEBI (Substantial Acquisition of shares and takeovers) Regulations, 2011.

ADRs generally also have two-way fungibility. Two-way fungibility meaning that investors, either foreign institutional or domestic, in any company, which has issued ADRs can freely convert ADRs into underlying domestic shares. Furthermore, they can also reconvert the domestic shares into ADRs, depending upon the market movements for the stock. The authorised dealers have been delegated with the authority to remit the funds received for purchase of shares or on account of cancellation of trade, under two-way fungibility of ADRs. Retention of proceeds of the Indian companies issuing shares to overseas depository for issuing ADRs are allowed to invest funds abroad for a temporary period pending repatriation to India. In furtherance, the companies may also retain abroad funds raised through ADRs, for any period to meet their future forex (foreign exchange market) requirements.

The paper also discussed the trading of ADRs in the U.S. and the U.S. Regulations in place for ADRs. It discusses the listing standards for securities particular to different stock exchanges, namely the NASDAQ and the New York Stock Exchange. The paper concludes keeping in mind various aspects of the legal requirements and applicability of the jurisdictional barrier provided and mandate by the statute, laws, authorities, etc. for ADRs/GDRs which are an essential part in raising the funds of any company outside their purview in the foreign capital markets.

INTRODUCTION

An American Depository Receipt, or ADR, is a security issued by a U.S. depository bank to domestic buyers as a substitute for direct ownership of stock in foreign companies. An ADR can represent one or more shares, or a fraction of a share, of a non-U.S. company. Individual shares of a foreign corporation represented by an ADR are called American Depositary Shares (‘ADS’).

An ADR is a convenient way for companies whose stock is listed on a foreign exchange to cross-list their stock in the United States and make their stock available for purchase by U.S. investors, as these receipts can be traded on U.S. exchanges.

Some ADRs are traded on major stock exchanges such as the NASDAQ Stock Market and the New York Stock Exchange, which require these foreign companies to conform with many of the same reporting and accounting standards as U.S. companies. Other ADRs are traded on over-the-counter exchanges that impose fewer listing requirements.

ADR programs frequently make a non-US company’s common shares a more appealing investment for US investors. Such programs create a new security (the ADR) that trades and settles in US dollars in the United States, in accordance with US market practice. In addition, the ADR program’s depositary will typically convert all dividend payments into dollars before disbursing them to investors. As a consequence, for certain institutional investors, ADRs are deemed to be US domestic securities and therefore are subject to fewer restrictions under internal investment guidelines. For similar reasons, ADRs may also attract US retail investor interest.

Key Benefits of ADR

Companies often find that the establishment of a depositary receipt program brings additional benefits. The increased visibility and investor base they gain by stepping outside their home market can enhance their international reputation, increase their share value, and heighten the profile of their company among the international investment community.

♦ Creates, broadens or diversifies investor base to include investors in other capital markets.

♦ Enhances visibility and global presence among investors, consumers and customers.

♦ Increases liquidity by tapping new investors.

♦ Develops and increases research coverage of your company.

♦ Improves communication with shareholders globally.

♦ Enables price parity with global peers.

♦ Offers a new venue for raising equity capital.

♦ Facilitates merger and acquisition activity by creating a desirable stock-swap “acquisition currency”.

TYPES AND LEVELS OF ADRs

TYPES OF ADRs

There are two basic types of ADR facilities, sponsored and unsponsored.

a) Unsponsored ADRs: An unsponsored ADR facility is one that is created without active participation from the foreign private issuer of the deposited securities. In case of an unsponsored ADR facility, the depositary must file a registration statement under the Securities Act, 1933 (‘Securities Act’) on Form F-6. Once this statement becomes effective, the depositary can accept deposits of securities of a foreign private issuer and issue ADRs with respect to such deposit. The ADR certificate acts as a contract between the ADR holder and the depositary. As a general rule, holders of unsponsored ADRs bear the costs of such facilities, which are passed on to the holders by way of fees for such deposit and withdrawal of deposited securities, and for other services. However, in recent years the trend in the creation of ADR facilities is towards sponsored, rather than unsponsored arrangements.

b) Sponsored ADRs: A sponsored ADR facility is created jointly by a foreign private issuer and a depositary. The Foreign private issuer signs the Form F-6 registration statement and enters into a depositary agreement with the depositary. This agreement governs the rights and responsibility of the parties, and sets forth the allocation of fees. In a typical sponsored ADR arrangement, a depositary agrees to provide notice of shareholders meeting and other information about the foreign private issuer so that ADR holders may exercise their voting rights through the depositary. The foreign private issuer pays administration fees, which are often waived, to the depositary for servicing and maintaining the program. A contractual relationship is established between the shareholder, the depositary, and the foreign private issuer by virtue of the depositary agreement. Additionally, the foreign private issuer in a sponsored ADR facility must establish an exemption from registration under Rule 12g3-2(b) of the Exchange Act, or else effect registration of its securities under this statute. A foreign private issuer enjoys several benefits by selecting a sponsored, rather than an unsponsored, ADR facility.

Among them are the following:

i. The foreign private issuer is able to maintain a greater degree of control over the ADR facility.

ii. With a sponsored ADR, the depositary generally does not deduct fees from dividends before paying them out of ADR holders. With an unsponsored ADR, this fee usually is deducted. Consequently, since holders of ADRs receive higher yield on their dividends, the sponsored facility is much attractive and marketable.

iii. Certain stock exchanges, including the American and NYSE, require sponsored ADRs as a prerequisite to listing.

These benefits have resulted in an increasing number of sponsored facilities and a corresponding decrease in the use of unsponsored ADR arrangements. Sponsored ADRs are those in which the non-U.S. company enters into an arrangement directly with the U.S. depositary bank to arrange for record keeping, forwarding of shareholder communications, payment of dividends, and other services.

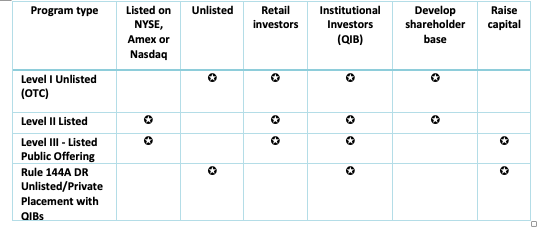

There are three levels of sponsored ADRs that are available to be listed on U.S. securities market. Each of these programs has different registration, regulatory, reporting and financial disclosure requirements. Since the financial disclosure and accounting practices and desires of the issuing company often determine its Listing options, we’ll start by Looking at unlisted programs vs. listed programs.

Unlisted programs (Level I and Rule 144A DRs)

A Level I ADR program is not listed on a stock exchange, but is available for retail investors to purchase and trade in the over-the-counter market via NASDAQ’s Pink Sheets. A Level I 1n of Securities Dealers pursuant to Rule 144a of the Securities Act of 1933.

• Are restricted to Qualified Institutional Buyers (QIBs) for purchase or trading.

• Are not registered with the US Securities and Exchange Commission.

At Least two years from the Last deposit of shares in the Rule 144A ADR facility, the ADRs issued under the Rule 144 program may be eligible to be merged into an unrestricted ADR facility.

Listed programs (Level II and Level III)

Listing an entity’s ADR means it will be traded on one of the three major US exchanges – the New York Stock Exchange (NYSE), The American Stock Exchange (Amex), or the National Association of Securities Dealers Automated Quotation System (NASDAQ). ADRs that are Listed on the NYSE or Amex, or quoted on NASDAQ, have higher visibility in the US market, are more actively traded, and have increased potential Liquidity.

In order to list an entity’s securities, the entity must meet the Listing requirements of the respective chosen exchange or market. The entity must also comply with the registration provisions and continued reporting requirements of the Securities Exchange Act of 1934, as amended (‘The Exchange Act’), as well as certain registration provisions of the Securities Act, which generally entail the following:

• Form F-6 registration statement, to register the ADRs to be issued.

• Form 20-F registration statement, to register the ADRs under the Exchange Act. This requires detailed financial disclosure from the issuer, including financial statements and a reconciliation of those statements to US GAAP (Generally Accepted Accounting Principles).

• Annual reports (on Form 20-F), filed on a regular, timely basis with the US Securities and Exchange Commission (SEC).

• Interim financial statements and current developments, furnished on a timely basis to the SEC on Form 6-K, to the extent such information is made public or filed with an exchange in the home country or distributed to shareholders.

A Level II ADR uses existing shares to satisfy investor demand and Liquidity. New ADRs are created from deposits of ordinary shares in the issuer’s home market. Because these securities are Listed or quoted on a major US exchange, Level II ADRs reach a broader universe of potential shareholders and gain increased visibility through reporting in the financial media. Listed securities can be promoted and advertised, and may be covered by analysts and the media. In addition, listed securities can be used to structure incentives for an issuer’s US employees, or could be used to facilitate US mergers and acquisitions.

Level III ADRs are a public offering of new shares into the US markets. These capital raisings have a high profile: They are followed closely by the financial press and other media, often generating significant visibility for the issuer. In addition to the requirements noted above, an issuer establishing a Level III ADR program:

• Is required to file form F-1. This registers the securities underlying the ADRs that will be offered publicly in the US, including a prospectus informing potential investors about the issuer and any risks inherent in its business, the offering price of the securities, and the issuer’s plan for distributing the ADRs. In certain circumstances, an abbreviated registration statement (form F-3) may be acceptable.

• May substitute Form 8-A for Form 20-F registration to register under the Exchange Act. However, Form 20-F annual reports must be filed thereafter. This annual filing contains detailed financial disclosure from the issuer, financial statements and a full reconciliation of those statements to US Generally Accepted Accounting Principles (GAAP).

Level III ADRs can be actively promoted and advertised to increase investor awareness and market Liquidity. As with Level II ADRs, the securities can be used to structure incentives for an issuer’s US employees, and may be used to facilitate US mergers and acquisitions.

INDIAN REGULATORY FRAMEWORK FOR ADRs

1. ELIGIBILITY CRITERIA

A. For Listed Companies

a) Eligibility of issuer: An Indian Company, which is not eligible to raise funds from the Indian Capital Market including a company which has been restrained from accessing the securities market by the Securities and Exchange Board of India (SEBI) will not be eligible to issue (i) Foreign Currency Convertible Bonds and (ii) Ordinary Shares through Global Depositary Receipts under the Foreign Currency Convertible Bonds and Ordinary Shares (Through Depositary Receipt Mechanism) Scheme, 1993 (‘Scheme’).

b) Eligibility of subscriber: Erstwhile Overseas Corporate Bodies (OCBs) who are not eligible to invest in India through the portfolio route and entities prohibited to buy, sell or deal in securities by SEBI will not be eligible to subscribe to (i) Foreign Currency Convertible Bonds and (ii) Ordinary Shares through Global Depositary Receipts under the Foreign Currency Convertible Bonds and Ordinary Shares (Through Depositary Receipt Mechanism) Scheme, 1993.

B. For Unlisted Companies

i) Earlier Provision

Unlisted companies, which have not yet accessed the ADR/GDR route for raising capital in the international market, would require prior or simultaneous listing in the domestic market, while seeking to issue such overseas instruments. Unlisted companies, which have already issued ADRs/GDRs in the international market, have to list in the domestic market on making profit or within three years of such issue of ADRs/GDRs, whichever is earlier.

ii) New Provision Introduced Vide A.P. (Dir Series) Circular No. 69 Dated November 8, 2013

It has now been decided to allow unlisted companies incorporated in India to raise capital abroad, without the requirement of prior or subsequent listing in India, initially for a period of two years, subject to conditions mentioned below. This scheme will be implemented from the date of the Government Notification of the scheme, subject to review after a period of two years. The investment shall be subject to the following conditions:

(a) Unlisted Indian companies shall list abroad only on exchanges in IOSCO/FATF compliant jurisdictions or those jurisdictions with which SEBI has signed bilateral agreements;

(b) The ADRs shall be issued subject to sectoral cap, entry route, minimum capitalisation norms, pricing norms, etc. as applicable as per FDI regulations notified by the Reserve Bank from time to time;

(c) The pricing of such ADRs to be issued to a person resident outside India shall be determined in accordance with the captioned scheme as prescribed under paragraph 6 of Schedule 1 of Notification No. FEMA 20 dated May 3, 2000, as amended from time to time;

(d) The number of underlying equity shares offered for issuance of ADRs to be kept with the local custodian shall be determined upfront and ratio of ADRs to equity shares shall be decided upfront based on applicable FDI pricing norms of equity shares of unlisted company;

(e) The unlisted Indian company shall comply with the instructions on downstream investment as notified by the Reserve Bank from time to time;

(f) The criteria of eligibility of unlisted company raising funds through ADRs shall be as prescribed by Government of India;

(g) The capital raised abroad may be utilised for retiring outstanding overseas debt or for bona fide operations abroad including for acquisitions;

(h) In case the funds raised are not utilised abroad as stipulated above, the company shall repatriate the funds to India within 15 days and such money shall be parked only with AD Category-1 banks recognised by RBI and shall be used for eligible purposes;

(i) The unlisted company shall report to the Reserve Bank as prescribed under sub-paragraphs (2) and (3) of Paragraph 4 of Schedule 1 to FEMA Notification No. 20.

(j) The Companies shall file a copy of the return which they submit to the proposed exchange/regulators also to SEBI for the purpose of Prevention of Money Laundering Act (PMLA). They shall comply with SEBI’s disclosure requirements in addition to that of the primary exchange prior to the listing abroad.

iii) New Provision Introduced Vide Press Note No. 7 (2013 Series) Dated December 3, 2013

Present Position: Unlisted companies, which have not yet accessed the ADR/GDR route for raising capital in the international market, would require prior or simultaneous listing in the domestic market, while seeking to issue such overseas instruments. Unlisted companies, which have already issued ADRs/GDRs in the international market, have to list in the

domestic market on making profit or within three years of such issue ADRs/GDRs, whichever is earlier. ADRs/GDRs are issued on the basis of the ratio worked out by the Indian company in consultation with the Lead Manager to the issue. Pending repatriation or utilization of the proceeds, the Indian company can invest the funds in:

a) Deposits, Certificate of Deposits or other instruments offered by banks rated by Standard and Poor, Fitch, IBCA, Moody’s etc. with rating not below the rating stipulated by Reserve Bank from time to time for the purpose;

b) Deposits with branch/es of Indian Authorized Dealers outside India; and

c) Treasury bills and monetary instruments with a maturity or unexpired maturity of one year or less.

Revised Position: The Government of India has reviewed the position in this regard and notified the Foreign Currency Convertible Bonds and Ordinary shares (Through Depository Receipt Mechanism) (Amendment) Scheme, 2013 vide Notification no. G.S.R. 684 (E) dated 11th October, 2013.

Unlisted Companies shall be allowed to raise capital abroad without the requirement of prior or subsequent listing in India initially for a period for two years subject to the following conditions:

(a) Unlisted companies shall list abroad only on exchanges on IOSCO/FATF complaint jurisdictions or those jurisdictions with which SEBI has signed bilateral agreement;

(b) The Companies shall file a copy of the return which they submit to the proposed exchange/regulators also to SEBI for the purpose of Prevention of Money Laundering Act (PMLA). They shall comply with SEBI’s disclosure requirements in addition to that of the primary exchange prior to the listing abroad;

(c) While raising resources abroad, the listing company shall be fully compliant with the FDI policy in force;

(d) The Capital raised abroad may be utilised for retiring outside overseas debt or for operations abroad including for acquisitions;

(e) In case the funds raised are not utilised abroad as stipulated at (d) above, such companies shall remit the money back to India within 15 days and such money shall be parked only in AD category banks recognised by RBI and may be used domestically.

2. PRICING OF ADRs:

The pricing of ADR issues including sponsored ADRs / GDRs should be made at a price determined under the provisions of the Scheme of issue of Foreign Currency Convertible Bonds and Ordinary Shares (Through Depository Receipt Mechanism) Scheme, 1993 and guidelines issued by the Government of India and directions issued by the Reserve Bank, from time to time.

A. For Listed Companies:

Issues should be made at a price not less than the higher of the following two averages:

(i) The average of the weekly high and low of the closing prices of the related shares quoted on the stock exchange during the six months preceding the relevant date;

(ii) The average of the weekly high and low of the closing prices of the related shares quoted on a stock exchange during the two weeks preceding the relevant date.

Relevant date – the date thirty days prior to the date on which the meeting of the general body of shareholders is held, in terms of provisions of the Companies Act, 2013, to consider the proposed issue.

B. For Unlisted Companies:

Pricing of ADRs to be issued to a person resident outside India shall be determined in accordance with the scheme as prescribed under FEMA regulations.

Utilization of Issue Proceeds:

ADRs are issued on the basis of the ratio worked out by the Indian company in consultation with the Lead Manager to the issue. The proceeds so raised have to be kept abroad till actually required in India. Pending repatriation or utilisation of the proceeds, the Indian company can invest the funds in:-

a. Deposits with or Certificate of Deposit or other instruments offered by banks who have been rated by Standard and Poor, Fitch or Moody’s, etc. and such rating not being less than the rating stipulated by the Reserve Bank from time to time for the purpose;

b. Deposits with branch/es of Indian Authorised Dealers outside India; and

c. Treasury bills and other monetary instruments with a maturity or unexpired maturity of one year or less.

There are no end-use restrictions except for a ban on deployment / investment of such funds in real estate or the stock market. There is no monetary limit up to which an Indian company can raise ADRs / GDRs. However issuer needs to comply with sectoral cap norms as notified under FEMA Regulations.

The ADR / GDR proceeds can be utilised for first stage acquisition of shares in the disinvestment process of Public Sector Undertakings / Enterprises and also in the mandatory second stage offer to the public in view of their strategic importance.

An Indian Company can raise foreign currency resources abroad through the issue of ADRs: – Such company however, has to comply with the requisites under the following policies and enactments:

• Eligibility under the FDI policy;

The ADRs are issued in accordance with the scheme for issue of Foreign Currency Convertible Bonds and Ordinary Shares (Through Depository Receipt Mechanism) Scheme, 1993 (hereinafter the 1993 Scheme) and guidelines issued by the Central Government from time to time. The 1993 Scheme entails the following requisites for an Indian company opting to issue ADRs:

A prior permission from the Department of Economic Affairs, Ministry of Finance, and Government of India Subject to the condition that:

(a) Such company has a consistent track record of good performance, financial or otherwise, for a minimum period of three years.

(b) Final approval of the issue structure from the Department of Economic Affairs.

(c) Limit: The ADRs shall be treated as a Foreign Direct Investment. The aggregate of the foreign investment made either directly or indirectly i.e. through ADRs shall not exceed 51% of the issued and subscribed capital of the issuing company. As far as the eligibility to subscribe to ADRs is concerned, erstwhile OCBs which are not eligible to invest in India and entities prohibited to buy, sell or deal in securities by SEBI shall not be eligible to subscribe to ADRs.

• Companies Act, 2013:

The Companies Act, 2013 defines ‘global depository receipt’ to mean any instrument in the form of a depository receipt, by whatever name called, created by a foreign depository outside India and authorised by a company making an issue of such depository receipts. It gives the Central Government the power to make rules regarding the manner and condition of issue of such DRs in any foreign country. This provision is an additional source of legal authority governing the issue of DRs. As per the draft SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2014, GDRs or ADRs have the same meaning as assigned to global depository receipts in the Companies Act, 2013.

• Income Tax Act, 1961:

The Income Tax Act provides for tax on income of a non-resident assessee from

1. interest on bonds of an Indian company;

2. dividends on Depository Receipts (DRs)

It specifically mentions that such DR issue must be in compliance with any scheme notified by the Central Government. This creates an additional power for the Central Government to make regulations on DRs.

3. TAXATION ASPECT OF ADRs

Taxation of income from any overseas securities including Depositories Receipts (DR) like Bonds, ADR, GDR etc. issued by Indian companies is dealt specifically under section 115AC (for other than employees of issuing company) and 115ACA (for employees of issuing company).

• Section 115AC of Indian Income Tax Act, 1961

(1) Where the total income of an assessee, being a non-resident, includes –

(a) income by way of interest or [Dividends other than dividends referred to in section 115-O], on bonds or shares of an Indian company issued in accordance with such scheme as the Central Government may, by notification in the Official Gazette, specify in this behalf, or on bonds or shares of a public sector company, sold by the Government and purchased by him in foreign currency; or

(b) Income by way of dividends [other than dividends referred to in section 115-O] on Global Depository Receipts –

(i) issued in accordance with such scheme as the Central Government may, by notification in Official Gazette, specify in this behalf, against the initial issue of shares of Indian company and purchased by him in foreign currency through an approved intermediary; or

(ii) issued against the shares of a public sector company sold by the Government and purchased by him in the foreign currency through an approved intermediary; or,

(iii) [issued or] re-issued in accordance with such scheme as the Central Government may, by notification in Official Gazette, specify in this behalf, against the existing shares of an Indian company purchased by him in foreign currency through an approved intermediary ;

(c) Income by way of long-term capital gains arising from the transfer of bonds or, as the case may be, shares referred to in clause (a), the income-tax payable shall be the aggregate of –

(i) The amount of income-tax calculated on the income by way of interest or [Dividends other than dividends referred to in section 115-O], as the case may be, in respect of bonds or shares referred to in clause (a), if any, included in the total income, at the rate of ten per cent;

(ii) The amount of income-tax calculated on the income by way of long-term capital gains referred to in clause (b), if any, at the rate of ten per cent; and

(iii) The amount of income-tax with which the non-resident would have been chargeable had his total income been reduced by the amount of income referred to in clause (a) and clause (b).

(2) Where the gross total income of the non-resident –

(a) consists only of income by way of interest or [Dividends other than dividends referred to in section 115-O] in respect of bonds or, as the case may be, shares referred to in clause (a) of sub-section (1), no deduction shall be allowed to him under sections 28 to 44C or clause (i) or clause (iii) of section 57 or under Chapter VI-A;

(b) Includes any income referred to in clause (a) or clause (b) of sub-section (1) the gross total income shall be reduced by the amount of such income and the deduction under Chapter VI-A shall be allowed as if the gross total income as so reduced, were the gross total income of the assessee.

(3) Nothing contained in the first and second provisos to section 48 shall apply for the computation of long-term capital gains arising out of the transfer of longterm capital asset, being bonds or shares referred to in clause (b) of sub-section (1).

(4) It shall not be necessary for a non-resident to furnish under sub-section (1) of section 139 a return of his income if –

(a) His total income in respect of which he is assessable under this Act during the previous year consisted only of income referred to in clause (a) of sub-section (1); and

(b) The tax deductible at source under the provisions of Chapter XVII-B has been deducted from such income.

(5) Where the assessee acquired shares or bonds in an amalgamated or resulting company by virtue of his holding shares or bonds in the amalgamating or demerged company, as the case may be, in accordance with the provisions of sub-section (1), the provisions of the said sub-section shall apply to such shares or bonds.

Section 115AC is amply clear that income (interest including dividend but not covered in Section 115-O) from DR’s to a non-¬resident is taxable at a concessional rate of 10%, similarly concessional rate is also applicable to resident employees as per Section 115ACA. Further, income by way of long-term capital gains on transfer of those DRs, are taxed at a concessional rate of 10% for non-resident as well as resident employees. The non-Resident further need not file his return of income if he has only income covered under this section taxable in India and appropriate TDS has been deducted on the said income. Further, since the DR is just a change in nomenclature of shares any transfer/ surrender of DR during a course of amalgamation/demerger under section 47 should not attract the term ‘Transfer’.

• Situs of DRs:

DR is issued by the overseas DP and is also redeemed through them only, hence, one can argue that the situs of DR is outside India. New explanation applying a look-at approach as ruled by the apex court and also viewing it from the eyes of ‘Substance over form’, Non-resident is ultimately holding share capital in Indian company and holding of shares instead of DR is just a change in nomenclature and only for convenience of liquidity and hassle free investment process.

Moreover the value of DR though traded on overseas stock exchanges is ultimately derived from the share value of that company in India. Concurrently, recent amendment in the Act wherein any capital asset whose substantial value is derived from assets situated in India is to be deemed as situated in India, in spite of the fact that DR is situated overseas the amendment extends the reach of section 9 of Act and deems DR to be situated in India. Though a stand can be taken that value of DR overseas on stock exchanges depends on demand and supply relationship on that exchange, the value of those DR substantially depends on what is the price of the underlying asset i.e. of shares in India or at Indian stock exchanges. Hence from the above it is impermissible to argue that situs of DR is not in India.

This is also seconded by intention of the Government by taxing the transfer of DR as capital gains under 115AC and 115ACA respectively.

Once the Situs of DR is concluded to be in India let us evaluate the tax liability on various options under Income Tax Act:

• Clause (viia) of Section 47 – Transactions not regarded as transfer

Any transfer of capital asset, being bonds, or [Global Depository Receipts] referred to in sub section (1) of section 115AC, made outside India by non-resident to another non-resident;]

i) Transfer of DRs to another Non-Resident:

Under this option as discussed above non-resident transfers the DR to another non-resident overseas in foreign exchange, this prima facie gets taxed under section 115AC of the Act. However, due to specific exemption given under section 47 of the Act the same is not treated as transfer and not liable to capital gain tax in India.

ii) Transfer of DRs to a Resident of India:

Though the ultimate purpose of going under this route is not clear from a resident’s prospective, since the exemption available under section 47 as taken under option 1 is not available here, since this is not a transfer made to non-resident, this transfer will squarely fall under section 115AC and will be taxed accordingly depending on whether it is short term capital gains or long term capital gains.

However, if the transfer is in the form of gift, this could have implications on the part of resident as receiver of gift under section 56 and accordingly will be taxed to resident as ‘Income from other sources’.

iii) Get DRs converted to shares and then sell them on Indian stock exchange:

This being the most complicated option, since there are two stages of transfers being done, one when the DRs are converted into equity shares and other when the equity shares are actually sold. Let us deal this stage wise:

Stage I: At this stage DR are converted into equity shares either to still hold them or to sell them off immediately. Irrespective of above since DRs and equity shares are two separate financial instruments with separate voting rights under the Companies Act, separate set of risks involved, separate returns expected from them, issuing authority also being different, and most importantly transfer of DRs is kept open for taxation under section 115AC of the Act. From the foregoing it would not be wrong to say that surrendering of DR in order to get shares in lieu of it is taxable in India.

Further, the scheme of ‘Issue of Foreign currency convertible bonds and ordinary shares (Through Depository Receipt Mechanism), 1993 states that value of shares acquired or say cost of acquisition of shares obtained by surrendering the DRs will be the market value of those shares as on the date of such shares getting credited to his D-mat account or getting the purchase note from the respective stock broker whichever is earlier, moreover the period of holding of those shares is also to be reckoned from the date of those shares getting credited to one’s account and not from the date from which DRs were held, from which is amply clear that stage I and II are separate taxable events.

Further, one more view is also possible that exchange of DR for equity is just moving from one class of deemed equity to another class of equity with new/separate rights which is similar to exchanging A class of equity for B class of equity which may still fall under the term ‘Transfer’ and capital gains may attract accordingly.

It is also pertinent to note that one of the clauses of section 47 mentions “any transfer by way of conversion of (bonds) or debentures, debenture stock, or deposit certificates in any form, of a company in to shares or debentures of that company” will not attract the provisions of section 45 i.e. charging section of capital gains under the Income Tax Act, 1961.

Few questions that arise from the above clause are, does the deposit certificate as mentioned above include DR, prima facie it does not look like because the relationship between lender and borrower which exists generally in a transaction of deposit is missing here, and an extremely aggressive stand would also not fall within the four walls of ‘Deposit certificates’. Another question that arise is, specific exemption for transfer of DR between Non-resident to Non-Resident is provided in the Act and, also specific provision to exclude conversion of bonds mentioned under section 115AC, (the same section where taxation of DR is mentioned), in to equity shares is been provided but there is no specific provision to exempt exchange of DR with equity from capital gains. Hence it can be safely be concluded that exchange of DR with equity is a taxable event.

The cost of acquisition taken for the above shares as discussed in the preceding paragraphs can also be treated as sale value for the DRs surrendered/ transferred/exchanged. Further one can also argue that getting equity by surrendering DR is not a transfer, but the definition of transfer is wide enough to include exchange of assets which in this case is of DR for equity shares, which via intermediaries ultimately happens between the company and share holder/DP holder.

To conclude stage I, the exchange being taxable and the computation of gain is done by taking sale value as mentioned in the above paragraph and cost of acquisition as actual cost incurred to acquire DR.

Stage 2: At this stage since the DRs are converted in to equity shares and are listed on Indian stock exchanges, there is no ambiguity as to the situs of the shares and depending on which type of capital gain is earned i.e. Long term which will be exempt under section 10(38) or Short term which will be taxed at a special concessional rate of 15%.

Further the mode of computation is also not complex since the cost of acquisition is derived as mentioned in the scheme as discussed above and sale value will be the net sale consideration received by selling the shares.

They (the companies) just need to report the details of such funds raised and retained abroad within 30 days from the date of closure of the issue to the Reserve Bank of India (RBI).

PROCESS AND INTERMEDIARIES

• Issue Process

The Scheme operates in a framework comprising of laws on companies, securities, foreign exchange, taxation, money laundering and market abuse. Over time, this framework has resulted in the creation of a market micro-structure around the issue of DRs. This section explains the steps involved in the issue of capital raising ADRs or GDRs by an Indian issuer company against its shares, under the present Scheme in conjunction with the existing market micro-structure:

1. The Indian issuer company must: (a) convene a board meeting to approve the proposed DR issue not exceeding ascertain value in foreign currency; (b) convene an Extraordinary General Meeting (EGM) for the approval of the shareholders for the proposed DR issue under the provisions of the Companies Act, 2013; (c) identify the agencies whose participation or permission it would require for the DR issuance; (d) convene a board meeting to approve the agencies; (e) appoint the agencies and sign the engagement letters.

2. The Indian legal counsel must undertake the due diligence.

3. The Indian issuer company must draft the information memorandum in consultation with the Indian legal counsel and submit the same to various agencies for their comments and then finalise it.

4. The listing agent must submit the information memorandum to the overseas stock exchange for their comments and in principle listing approval.

5. The Indian issuer company must simultaneously submit the draft information memorandum to the Indian stock exchanges where the issuing company’s shares are listed for in principle approval for listing of the underlying shares.

6. The Indian issuer company must hold a board meeting to approve the issue.

7. Pursuant to steps 4 and 5, on receipt of the comments on the information memorandum from the overseas and Indian stock exchanges, the Indian issuer company must incorporate the same and file the final information memorandum with the overseas and Indian stock exchange and obtain final listing approval.

8. The Indian issuer company can open the issue for the DRs on receipt of the in principle listing approval from the overseas and the Indian stock exchanges.

9. The Indian issuer company must open the escrow account with the escrow agent and execute the escrow agreement.

10. The Indian issuer company, in consultation with the lead manager (merchant banker), must finalise: (a) Whether the DRs will be through public or private placement. (b) The number of DRs to be issued. (c) The issue price. (d) Number of underlying shares to be issued against each DR.

11. On the day of the opening of the issue, the Indian issuer company must execute the deposit and subscription agreements.

12. The issue should be kept open for a minimum of three working days.

13. Immediately on closing of the issue, the Indian issuer company must convene a board or committee meeting for allotment of the underlying shares against the issue of the DRs.

14. The Indian issuer company must deliver the share certificates to the domestic custodian bank who will in terms of the deposit agreement instruct the overseas depository bank to issue the DRs to non-resident investors against the shares held by the domestic custodian bank.

15. On receipt of listing approval from the overseas stock exchange, the Indian issuer company must submit the required documents for final in principle listing approval from the Indian stock exchange.

16. After DRs are listed, the lead manager must instruct the escrow agent to transfer the funds to the Indian issuer company’s account.

17. The Indian issuer company can either remit all or part of the funds, as per its discretion.

18. On obtaining the final approval from the Indian stock exchange, the Indian issuer company can admit the underlying shares to the depository, that is, National Securities Depository Limited (NSDL) or Central Depository Services (India) Limited (CDSL).

19. The Indian issuer company must obtain trading approval from the stock exchange.

20. The Indian issuer company must intimate the custodian for converting the physical shares into dematerialised form.

21. Within 30 days of the closing of the DRs issue, details of the DRs issue along with the information memorandum should be submitted to various authorities.

22. Return of allotment is to be filed with Registrar of Companies within 30 days of allotment.

23. Indian issuing company is to file a specified format annexed to Schedule I, FEMA 20 with RBI Central Office within 30 days of closure of the DRs issue.

24. The Indian issuer company is to file a quarterly return in a specified format annexed to Schedule I, FEMA 20 within 15 days of the close of the calendar quarter.

VOTING RIGHTS ASPECT OF ADRs & INDIAN EXPERIENCE WITH ADRs

The Voting Rights of American Depository Receipts holders are determined primarily by the terms of the Deposit Agreement and are guided by the rules of the stock exchange where the ADRs are listed (if any) and also, by the laws of the Issuer’s home market.

The Deposit Agreement may give ADR holders a contractual right to instruct the Depositary to vote on matters that have been submitted for shareholder approval, provided it is legal and reasonably practicable to do so. If these preconditions are met, then pursuant to the terms of the Deposit Agreement, the rules of the relevant stock exchange and home market law, and an instruction from the Issuer to do so, the Depositary will extend the voting rights to the ADR holders. The Depositary then vote, or cause to be voted, such shares for which instructions are received from ADR holders in accordance with such instructions.

The Depositary does not itself exercise any voting discretion and will cause underlying shares to be voted only to the extent it has received proper and timely instructions from ADR holders, and only in accordance with such instructions. Any shares for which instructions have not been received from the underlying ADR holders would generally remain un-voted. However, if the issuer so requests, in situations where the depositary is provided a legal opinion by the issuer’s counsel to the effect that voting on behalf of non- instructing DR holders does not violate home market law, a discretionary proxy can be granted to the issuer permitting it to vote the shares represented by un-voted DRs on certain matters.

Issuers should be made aware, however, that the larger market participants generally do not hold a favourable view of discretionary proxies.

Initially, the ADR holders were not entitled to voting rights. Although, the situation improved when, in 2009, they were made entitled to vote on the underlying shares. However, this was subject to the clauses in the terms of issue or agreements between the holders of these instruments and the issuers. This practically negated the possibility of exercising the voting rights.

This is why SEBI recently recommended for a change in current rules to allow ADR holders to exercise their voting rights, raising the possibility of increased shareholder activism in future.

INDIA EXPERIENCES WITH ADRs

In the year 2005, the Ministry of Finance, India disallowed issuance of GDRs without listing in India. Before such restriction was imposed, companies such as Sify, Satyam Infoway and Rediff raised substantial amount of funds through listing their GDRs/Foreign Currency Convertible Bonds (“FCCBs”) in foreign stock exchanges and continue to remain to be unlisted in India.

The Securities Exchange Board of India (“SEBI”) supported this move since it believed that it would help the development of domestic capital markets and shall also give it regulatory control over companies issuing GDRs/FCCBs

However, the poor performance of the domestic capital markets in recent years and the consequent impact on the market sentiment has made it difficult for companies to raise money from domestic capital market. In such a situation, Indian groups or their founders have started setting up offshore companies (that through their Indian subsidiary owned the Indian asset) and are solely dedicated towards raising funds abroad.

These offshore companies were then listed on the back of their Indian subsidiary holding the Indian asset. In this background, it seems the government has now decided to permit Indian unlisted companies to issue ADRs/ GDRs without the requirement to list in the domestic stock exchange. Under the chairmanship of Mr. M. S. Sahoo, Secretary, Institute of Company Secretaries of India, a committee was constituted on January 10, 2014 to review the entire framework of access to domestic and overseas capital markets and related aspects. The Committee in its report suggested reforms in the framework of domestic depository.

U.S. REGULATIONS FOR ADRs

In order for a non-U.S. company to place their ADRs on U.S. securities market, they have to comply with Securities and Exchange regulations and reporting requirements, so there is more assurance for the U.S. investor that the shares they are purchasing meet the standards applicable for U.S. companies, and that there will be the same level of transparency in reporting.

ADRs are traded in the same way as U.S. stocks, and are listed on the New York Stock Exchange, the American Stock Exchange, or are traded on the NASDAQ or on the over-the-counter market. ADRs are traded according to U.S. market practices, are quoted in U.S. dollars, and dividends are paid in U.S. dollars.

U.S. investors generally prefer to purchase ADRs rather than ordinary shares in the issuer’s home market because ADRs trade, clear and settle according to U.S. market conventions.

1. TRADING OF ADRs

ADRs are traded in the United States using the same facilities as equity securities, including the New York Stock Exchange and NASDAQ. Purchasers and sellers of ADRs range from retail customers and institutional investors to arbitragers and brokers. The prices at which ADRs are traded are influenced by several factors, including the price of the depositary security in its home market and foreign currency rates.

The actual certificates for ADRs are typically held by securities depositaries, which hold the ADRs in their vaults and keep computerized book keeping entries of the transfer of ADRs, payment of dividends and related matters. Thus, ADRs may be purchased through brokerage firms like any other securities.

2. FEDERAL REGULATIONS OF ADRs

Two principal bodies of law provide the primary federal regulation of ADR issuance and trading. The first of these statues, the Securities Act of 1933, governs public distributions by a foreign private issuer of ADRs and its affiliates in the United States. The second, the Securities Exchange Act of 1934, governs secondary trading in ADRs in U.S. capital market.

a) SECURITIES ACT OF 1933

Under the Securities Act of 1933 (‘the Securities Act’), the depositary shares represented by the ADRs are securities, separate and apart from the deposited foreign securities they represent. Unless an exemption is available, the ADRs must be registered under the Securities Act before they may be publicly distributed within the United States.

When a foreign private issuer wants to raise capital in the U.S. market through a public offering, such issuer generally proceeds in a manner similar to that of a U.S. issuer conducting a domestic offering. In most of ADR offerings, the foreign private issuer files two registration statements:

i. Form F-6, to register the depositary shares; and

ii. Form F-1 (used for initial public offerings of ADRs), Form F-2 and F-3 (are used by foreign private issuer that have previously registered securities under Securities Act or the Exchange Act) or Form F-4 (used for securities issued in business combinations including certain reclassifications, mergers, consolidations, transfers of assets and exchange offers.

b) SECURITIES EXCHANGE ACT OF 1934

• Form 20-F registration statement, to register the ADRs under the Exchange Act. This requires detailed financial disclosure from the issuer, including financial statements and a reconciliation of those statements to U.S. GAAP.

• Form 2-F may be used by foreign private issuers to register depositary shares under the Exchange Act if either the depositary or the legal entity created by the agreement for ADRs signs the registration statement describing the ADRs and the depositary shares.

• Annual reports (on Form 20-F), filed on a regular basis with the U.S. Securities and Exchange Commission (SEC).

• Interim financial statements and current developments, furnished on a timely basis to the SEC on Form 6-K, to the extent such information is made public or filed with an exchange in the home country or distributed to shareholders.

3. SEC REQUIREMENTS

ADRs are always registered with the SEC on a Form F-6 registration statement. Disclosure under Form F-6 relates only to the contractual terms of deposit under the depositary agreement and includes copies of the agreement, a form of ADR certificate, and legal opinions. A Form F-6 contains no information about the non-U.S. company. If a foreign company with ADRs wishes to raise capital in the U.S., it would separately file a registration statement on Form F-1, F-3 or F-4. If a foreign private issuer seeks to list ADRs on a U.S. Stock Exchange, it would separately file with the SEC a registration statement on Form 20-F. Registration statements used to raise capital or list ADRs on an exchange are required to contain extensive financial and non-financial information about the issuer.

4. STOCK EXCHANGE REQUIREMENTS

To be listed initially, a company must meet minimum financial and non-financial standards. Among other things, the standards cover total market value, stock price, and the number of publicly traded shares and shareholders a firm has. After a company’s stock starts trading on an exchange, it usually is subject to other, less stringent requirements; if it fails to meet those, the stock can be delisted. The listing requirements particular to the NASDAQ and the New York Stock Exchange are provided in detail:

NASDAQ STOCK EXCHANGE

a) NASDAQ Market Tiers: The NASDAQ Stock Market has 3 distinctive tiers: The NASDAQ Global Select Market®, The NASDAQ Global Market® and The NASDAQ Capital Market®. Applicants must satisfy certain financial, liquidity and corporate governance requirements to be approved for listing on any of these market tiers. As illustrated in the following tables, the initial financial and liquidity requirements for the NASDAQ Global Select Market are more stringent than those for the NASDAQ Global Market and likewise, the initial listing requirements for the NASDAQ Global Market are more stringent than those for the NASDAQ Capital Market. Corporate governance requirements are the same across all NASDAQ market tiers. It is important to note that even though a company’s securities meet all enumerated criteria for initial inclusion, NASDAQ may deny initial listing, or apply additional conditions, if necessary to protect investors and the public interest.

b) Overview of Initial Listing Requirements: The following charts provide an overview of the criteria companies must satisfy:

NASDAQ Global Select Market: Financial Requirements

Companies must meet all of the criteria under at least one of the four financial standards below and the applicable liquidity requirements on the next page. These requirements apply to listing the primary class of securities for an operating company. Refer to the Listing Rules for specific requirements as they pertain to closed end funds, structured products and secondary classes.

| Financial Requirements | Standard 1: Earnings | Standard 2: Capitalization with Cash Flow | Standard 3: Capitalization with Revenue | Standard 4: Assets with Equity |

|---|---|---|---|---|

| Listing Rules | 5315(e) and 5315(f)(3)(A) | 5315(e) and 5315(f)(3)(B) | 5315(e) and 5315(f)(3)(C) | 5315(e) and 5315(f)(3)(D) |

| Pre-Tax Earnings (income from continuing operations before income taxes) | Aggregate in prior three fiscal years > $11 million and Each of the prior three fiscal years > $0 and Each of the two most recent fiscal years > $2.2 million |

— | — | — |

| Cash Flows | — | Aggregate in prior three fiscal years > $27.5 million And Each of the prior three fiscal years > $0 | — | — |

| Market Capitalization | — | Average > $550 million over prior 12 months | Average > $850 million over prior 12 months | $160 million |

| Revenue | — | Previous fiscal year > $110 million | Previous fiscal year >$90 million | — |

| Total Assets | — | — | — | $80 million |

| Stockholders’ Equity | — | — | — | $55 million |

| Bid Price | $4 | $4 | $4 | $4 |

NASDAQ Global Select Market: Liquidity Requirements

| Liquidity Requirements |

Initial Public Offerings and Spin-Off Companies | Seasoned Companies: Currently Trading Common Stock or Equivalents | Affiliated Companies | Listing Rule |

|---|---|---|---|---|

| Round Lot Shareholders or Total Shareholders or Total Shareholders and Average Monthly Trading Volume over Past Twelve Months | 450 or 2,200 | 450 or 2,200 or 550 and 1.1 million | 450 or 2,200 or 550 and 1.1 million | 5315(f)(1) |

| Publicly Held Shares | 1.25 million | 1.25 million | 5315(e)(2) | |

| Market Value of Publicly Held Shares or Market Value of Publicly Held Shares and Stockholders’ Equity | $45 million | $110 million or $100 million and $110 million | $45 million | 5315(f)(2) |

*The Company must also have four registered and active Market Makers unless it satisfies the requirements of the NASDAQ Global Market Income Standard or Equity Standard as set forth on the next page, in which case it must have three registered and active Market Makers.

NASDAQ Capital Market: Financial and Liquidity Requirements

| Requirements | Equity Standard | Market Value of Listed Security Standard | Net Standard Income |

|---|---|---|---|

| Listing Rules | 5505(a) and 5505(b)(1) | 5505(a) and 5505(b)(2) | 5505(a) and 5505(b)(3) |

| Stockholders’ Equity | $5 million | $4 million | $4 million |

| Market Value of Publicly Held Shares | $15 million | $15 million | $5 million |

| Operating History | 2 years | — | — |

| Market Value of Listed Securities | — | $50 million | — |

| Net Income from Continuing Operations (in the latest fiscal year or in two of the last three fiscal years) | — | — | $0.75 million |

| Publicly Held Shares | 1 million | 1 million | 1 million |

| Shareholders (round lot holders) | 300 | 300 | 300 |

| Market Makers | 3 | 3 | 3 |

| Bid Price OR Closing Price** | $4/$3 | $4/$2 | $4/$3 |

* Currently traded companies qualifying solely under the Market Value Standard must meet the $50 million Market Value of Listed Securities and the applicable bid price requirement for 90 consecutive trading days before applying.

** To qualify under the closing price alternative, a company must have: (i) average annual revenues of $6 million for three years, or (ii) net tangible assets of $5 million, or (iii) net tangible assets of $2 million and a 3 year operating history, in addition to satisfying the other financial and liquidity requirements listed above.

CONCLUSION

Everything has its own “pros and cons” but after analysing the whole structure and mechanism of financial markets all over the world focusing mainly US and India, the report can finally make a view point that there is a need for amendments and further liberalisation in Indian financial rules and regulations in accordance with the present scenario, which is more indeed apt to state that there can be no comparison between the regulations prevalent in US and India as the latter is yet to match up to the standards of the former in securities market. US had introduced ADRs in 1927 and at present, the regulations governing ADRs are close to perfect. This concluding approach mentioned above is based upon the following findings which are prevalent in Indian financial or capital market:

Market abuse: Recent incidents have shown that the DR route may be used to commit market abuse in India. At the same time, imposing stricter regulations on Indian firms who wish to participate in the international capital market will increase their cost of capital. The regulations must strike a balance between these two.

Stringent eligibility norms: The stringent eligibility criteria, disclosure and corporate governance norms, though in the investor’s interests, compare unfavourably with that of the Unsponsored and Sponsored Level I program of ADRs. This has resulted in higher compliance costs for mid-sized companies seeking to tap the Indian capital markets.

No automatic fungibility, no arbitrage opportunities for investors and issuers: The ADR holders enjoy two-way fungibility option (conversion of GDR/ADR into underlying shares and vice versa) while investors in GDRs/IDRs can exercise the option only after one year (as per regulation). Two-way fungibility enables an investor to benefit from any arbitrage opportunities arising due to exchange rate fluctuations or quotation differences on the two stock exchanges. An IDR investor is denied of this opportunity.

Also, the issuer is required to immediately repatriate the rupee funds through IDR proceeds back to the home country. By not allowing them to park their rupee funds in India, they cannot take advantage of any interest arbitrage opportunity. Also, given the fact that rupee is not a floating currency, it would entail conversion into dollars or other hard currency and then being repatriated. This would exert pressure on the rupee.

Lack of clarity on taxation issue: It is not very clear whether GDRs are exempt from capital gains tax; this could be a potential roadblock. As per current Income tax laws, Securities which are held for more than 1 year are exempt from capital gains tax and for less than 1 year tax is 15%. Treating IDRs at par with shares for taxation purpose till the new tax code comes into effect in 2011 will help promote IDRs. Issue of Foreign Currency Convertible Bonds and Ordinary Shares (Through Depository Receipt Mechanism) Scheme, 1993 provides guidance as regards the taxation of income that would arise to foreign investors from investing in these Securities. Similar guidance is required to clarify the taxability of IDRs.

Indian Financial Markets still quite volatile: US being a developed country has less political flux, which lends stability to its financial market. Instead, Indian markets are perceived to be rumour driven which leads to heightened volatility.

References

1) http://www.supremecourtcases.com/index2.php?option=com_content&itemid=54&dpdf=1&id=22274

2) http://barandbench.com/content/212/viewpoint-indian-depository-receipts

3) http://www.finmin.nic.in/reports/Sahoo_Committee_Report.pdf

4) http://finmin.nic.in/the_ministry/dept_eco_affairs/ecb/ForConBondsScheme1993.pdf

5) http://www.finmin.nic.in/press_room/2014/Report_committee_framework_Capitalmarket.pdf

6) http://www.finmin.nic.in/the_ministry/dept_revenue/idr_report_20140609.pdf

7) https://www.pwc.in/assets/pdfs/Publications-2010/Indian_Depository_reciept.pdf

8) http://www.manupatrafast.com/articles/PopOpenArticle.aspx?ID=4abecfc7-4af9-4788-bb24-9509ab6acdb4&txtsearch=Subject:%20Capital%20Market

9) https://www.pwc.in/assets/pdfs/Publications-2010/Indian_Depository_reciept.pdf

10) http://law.incometaxindia.gov.in/dittaxmann/incometaxacts/2005itact/section115AC.htm

GLOSSARY

| Abbreviations / Terms | Full Form / Description |

|---|---|

| ADR | American Depository Receipts |

| AIM IPO | Initial Public Offer on AIM exchange |

| AR | Admission Responsibility |

| AS | Accounting Standard |

| Australian IFRS | Australia’s International Financial Reporting Standards |

| CGT | Capital Gain Tax |

| Canadian GAAP | Generally Accepted Accounting Principles of Canada |

| BIFR | Board for Industrial and Financial Reconstruction |

| BPR | Business Property Relief |

| DCF | Discounted Cash Flow |

| DI | Depository Interest |

| DR | Depository Receipt |

| EEA | European Economic Area |

| EIS | Enterprise Investment Scheme |

| ER | Engagement Responsibility |

| FDI | Foreign Direct Investment |

| FEMA | Foreign Exchange Management Act, 1999 |

| FII | Foreign Institutional Investors |

| FIPB | Foreign Investment Promotion Board |

| FSA | Financial Services Authority |

| FTSE | Financial Times and (London) Stock Exchange |

| GDR | Global Depository Receipts |

| HMRC | A non-ministerial department of the U.K. Government responsible for the collection of taxes |

| IAS | International Accounting Standard |

| IHT | Inheritance Tax |

| IPO | Initial Public Offer |

| IRDA | Insurance Regulatory Authority of India |

| Japanese GAAP | Generally Accepted Accounting Principles of Japan |

| LR | Listing Rules (United Kingdom) |

| “LSE” or “Main Market” | London Stock Exchange |

| NASDAQ | National Association of Securities Dealers Automated Quotation System American stock exchange |

| NBFC | Non-Banking Finance Company |

| Nomad | Nominated Advisor |

| NRI | Non Resident Indian |

| OCB | Overseas Corporate Bodies |

| OR | On-going Responsibility |

| OTCEI | Over The Counter Exchange of India |

| QIP | Qualified Institutional Placement |

| RBI | Reserve Bank of India |

| RIS | Regulatory Information Services |

| SEBI | Securities and Exchange Board of India |

| SEBI ICDR | SEBI (Issue of Capital and Disclosure Requirement) Regulations, 2009 |

| SME | Small & Medium Scaled Enterprises Exchange |

| SSI | Small Scale Industries |

Interested in this topic or wanting to know more? Share your thoughts and we will be happy to assist.